Money-Saving Apps: Our Top Picks

Short on time? Here’s a quick rundown of the best money-saving apps for iOS – for budgeting, driving, shopping, eating, and boosting your credit. We’ve only included free money-saving apps, or apps with free plans that have an extensive range of features, so you can start saving today.

- Mint: a real-time overview of all your bank accounts

- GasBuddy: the cheapest fuel prices near you

- Ruby: combining all the ways to save at a store and simplifying loyalty programs

- Too Good To Go: surplus, discounted food from local restaurants

- Experian: free credit reporting and FICO score boosts

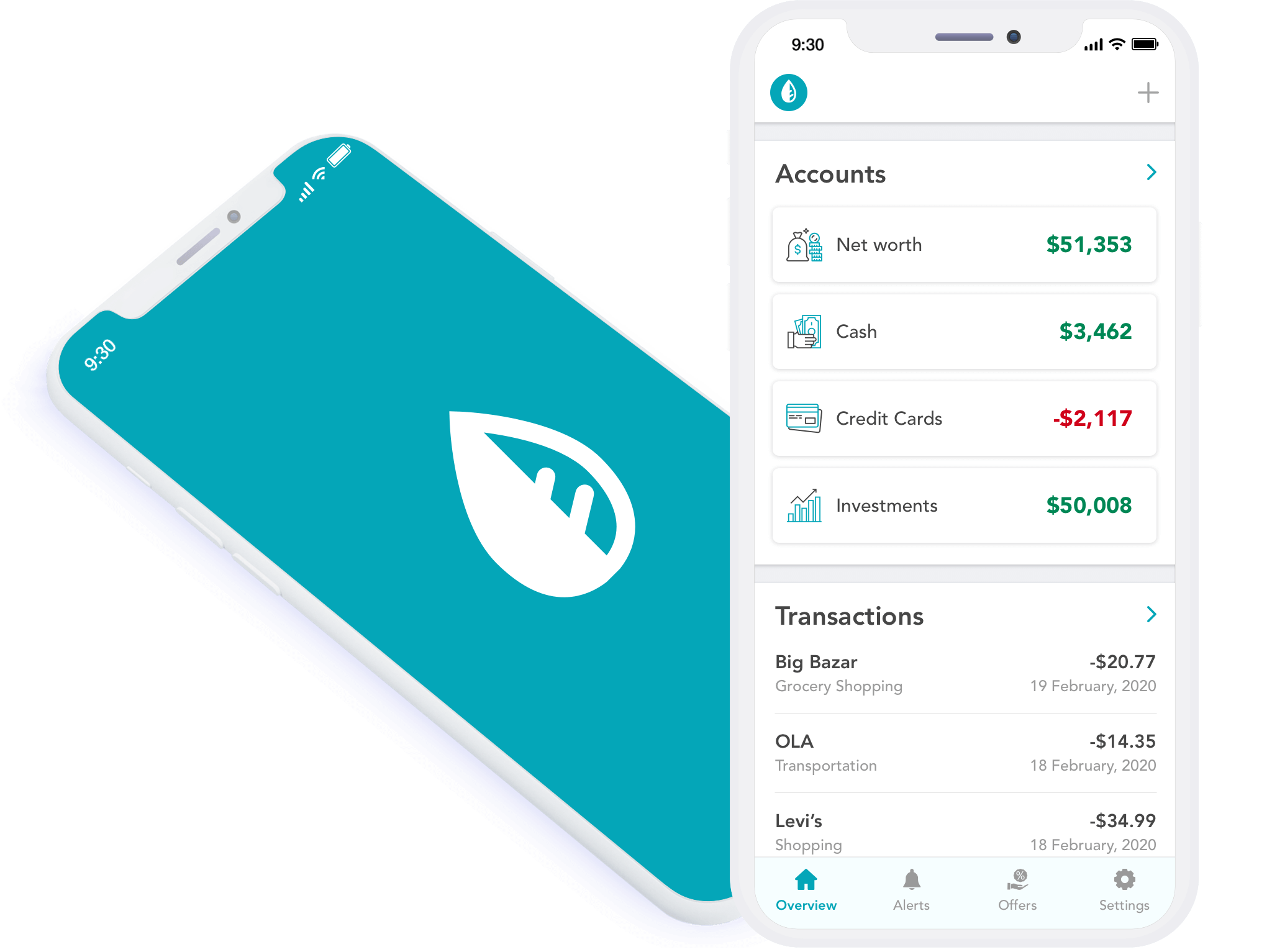

Mint: For Bringing Everything Together

This one’s for savers who like to make goals and smash them. Never miss a bill again. Mint streamlines all your accounts into one place, giving you a simple, accurate view of your finances. You can create budgets, monitor your credit and track your spending – all for free. You can even set custom goals, a great way to keep on top of saving, whether that’s for a holiday or a down payment.

Mintsights is where the game really steps up: smart, personalized and relevant insights to help you spend better, pay off debt, and find opportunities to save.

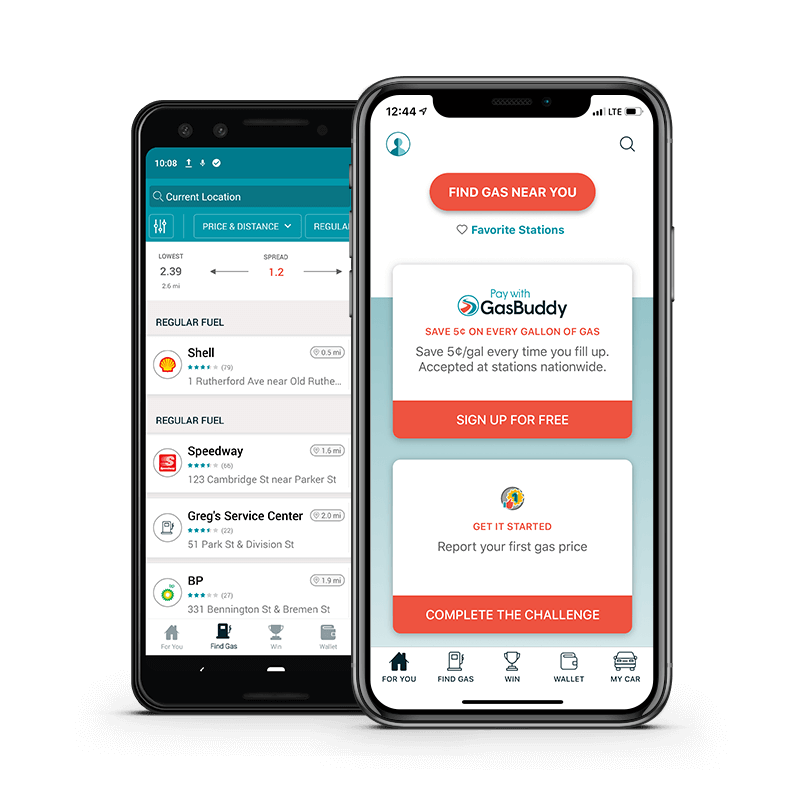

GasBuddy: For Saving On Fuel

Responsible for providing $990m total savings per year, GasBuddy is the easiest way to save on fuel. Access tools like the trip cost calculator, outage tracker, and best of all: the fuel price search. On the app or on the site, you can search for the cheapest fuel prices by state, meaning you never pay more than you need to.

If you drive long journeys often, the gas price map on the app helps you plan your route while on-the-go, so you can stop off at the cheapest fuelling stations. Over time, the savings really stack up!

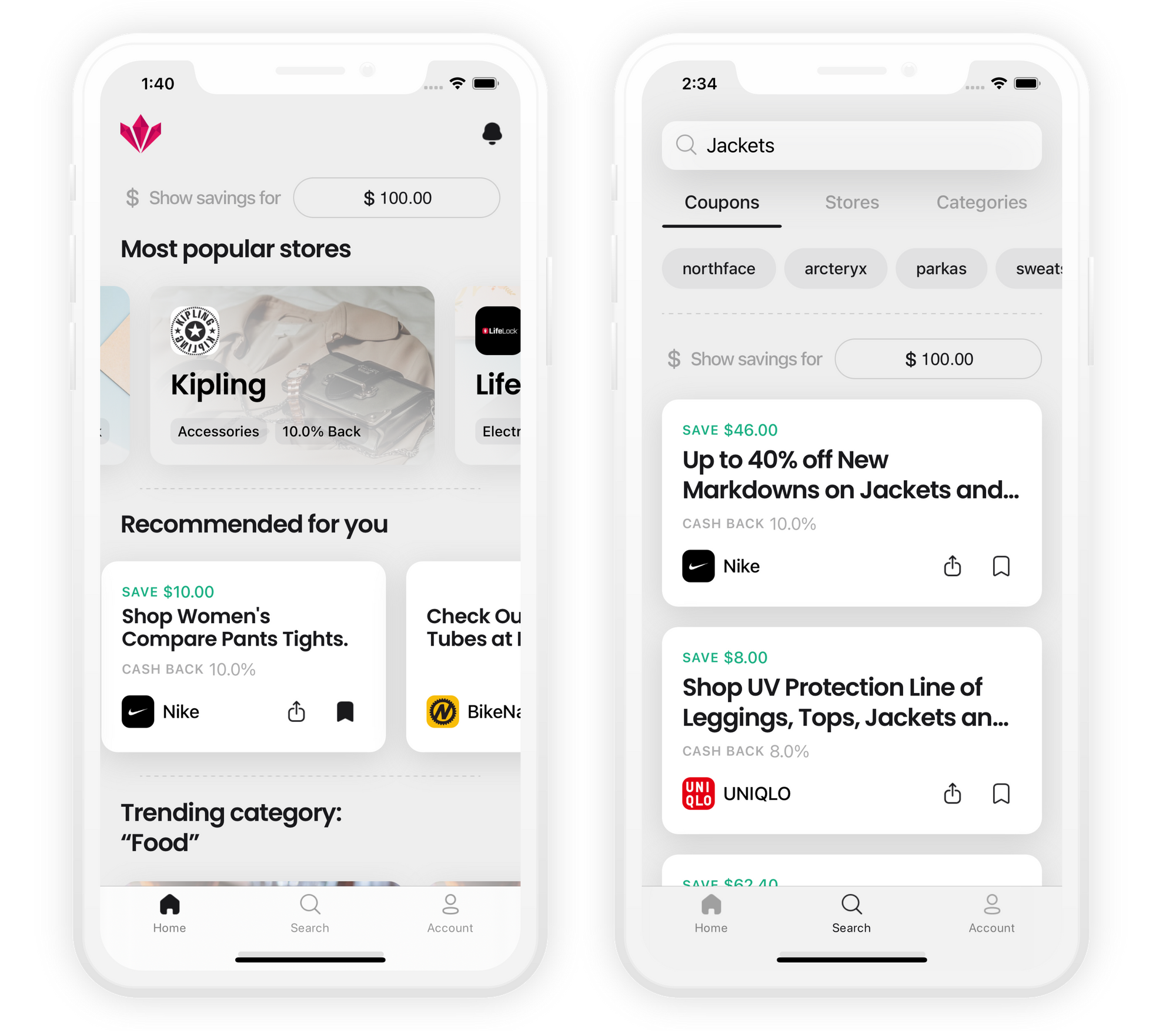

Ruby: For All the Discounts

Every store has discounts and offers to entice you, as well as unique loyalty programs that help shoppers earn money back. The savings are out there, but with secret discounts, exclusive offers, and brand-specific T&Cs, stacking up those savings can be near-impossible.

That’s where Ruby steps in. Ruby automatically calculates your total savings before checkout – taking into account cashback, discounts, coupon codes, and loyalty. Browse all the available discounts at each store and see the loyalty program broken down in the simplest terms. That means we convert dollars to points (and points to dollars), giving you the clearest snapshot of how to take advantage of loyalty programs.

Shop at all your favourite stores like normal, via the app – your promo code will be applied automatically. Ruby doesn’t just make saving easy – it’s also the smartest money-saving app for shopping. The app uses AI to understand your shopping behavior and presents you with the best, most relevant savings. We also provide you personalized stacked savings you can’t find anywhere else – based on where and how you prefer to shop and save.

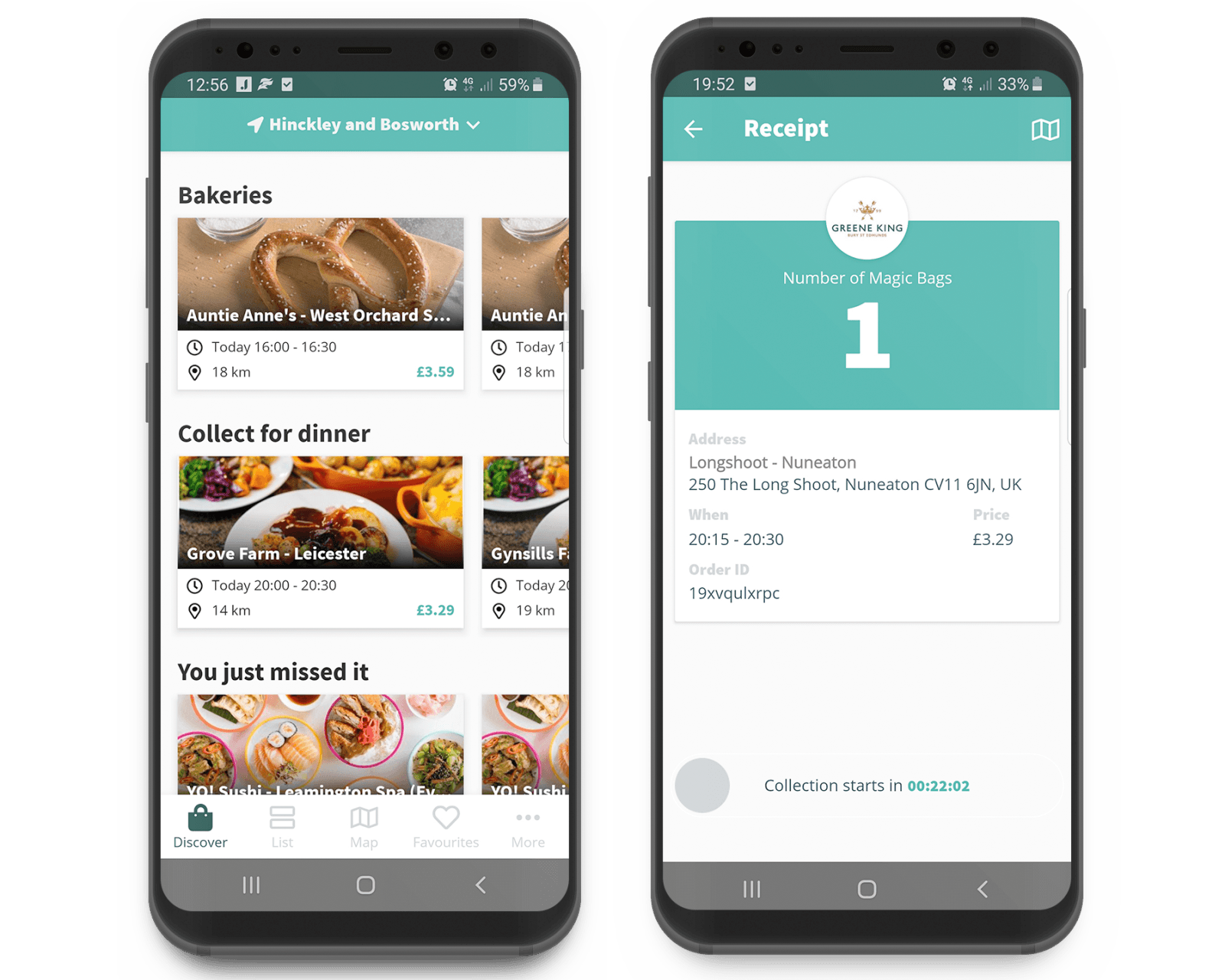

Too Good To Go: For Eliminating Food Waste

1/3 of all food, globally, is wasted. In the USA, each day, 1 pound of food per person is wasted.

Too Good To Go is on a mission to reduce food waste. To date, they’ve saved 80 million meals by connecting bargain-hungry, eco-friendly foodies with restaurants and stores.

Here’s how it works: chains and independents list “Surprise Bags”, bundles of discounted food that hasn’t sold today.

If you’re in New York City, Boston, Philadelphia, Washington, D.C., San Francisco, Seattle, or Portland, there are plenty of quick bites and adventurous dishes to try on Too Good To Go. The app hasn’t launched anywhere else in the US yet, but anyone can give them a follow on Instagram for tips on saving food (which means saving money too!

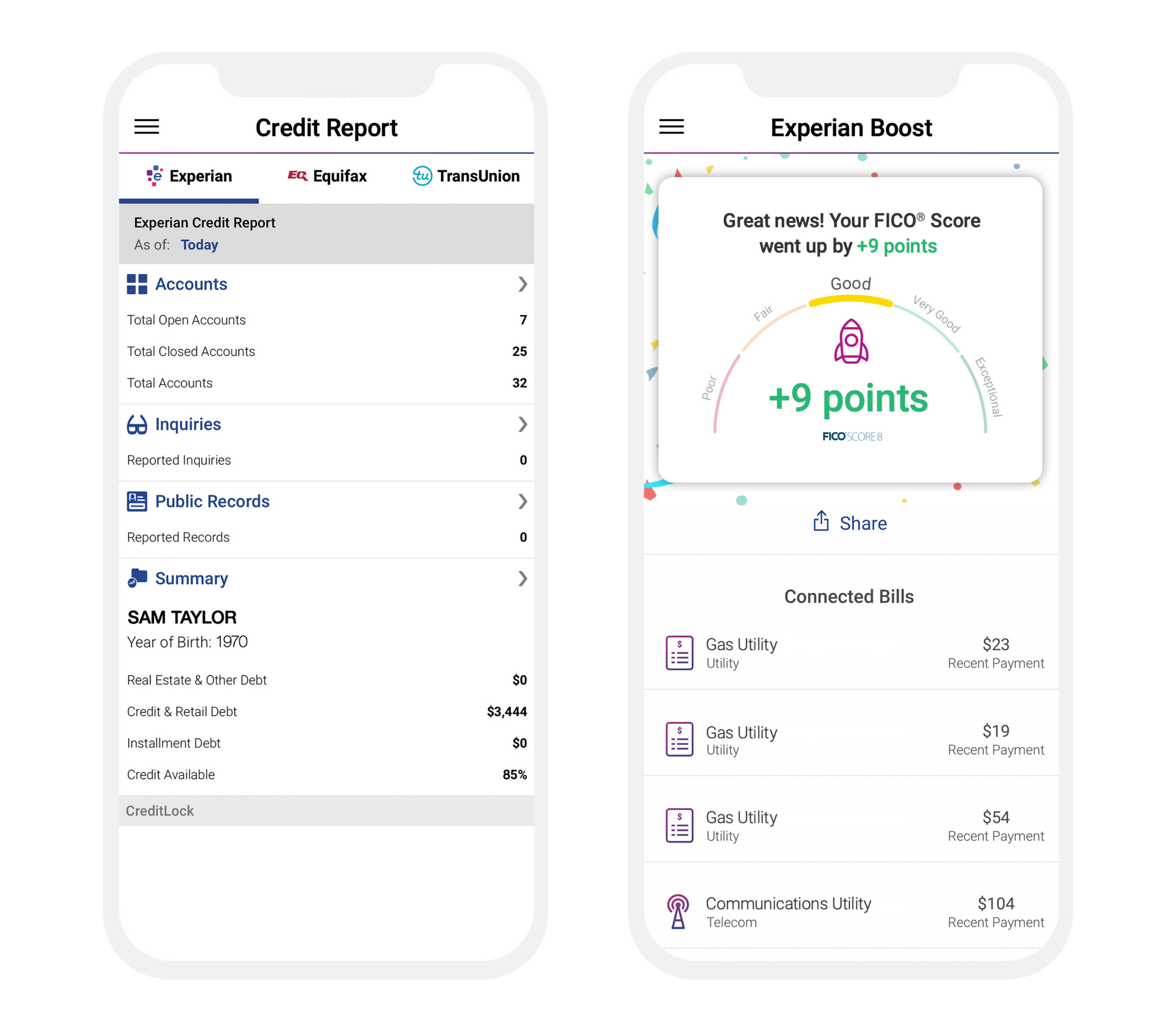

Experian: For Credit Boosting

There are dozens of credit tracking apps, and lots of budgeting apps that connect to your bank accounts offer a credit score feature. But no app makes improving personal credit just as easy as Experian. The app boasts a whole range of free tools, including credit reporting, scoring, and monitoring.

What really sets Experian apart is Experian Boost. For free, you can boost your FICO score by getting credit for bills like phone, utilities, and streaming. That means you can earn credit for your existing subscriptions to Netflix, HBO, and Disney.

By tracking your credit and using Experian Boost to improve your credit score, you can qualify for better interest rates and lower finance charges on loans. Improving your score through a credit repair scheme can cost thousands of dollars, so Experian is the smart saver’s alternative.

Saving with iOS Apps

That’s our round-up of the top 5 tools you need in your arsenal to save the most in 2021. Whether you’re travelling (GasBuddy), eating (Too Good To Go), or planning for the future (Experian), there’s an iOS app that makes saving easy. Use all these apps together to save the most: set dedicated shopping budgets in Mint and make the most out of it with savings through Ruby. Or stack up loyalty points on big purchases through Ruby, pay on credit, and track how your FICO score improves on Experian.

Our team is pretty passionate about saving money. That’s why we use all the apps listed – and why we created the best money-saving app for shopping: Ruby.